Assessing the industry impact of the section 45X advanced manufacturing credit

ARTICLE | April 28, 2023

Authored by RSM US LLP

Manufacturing executives are navigating how to maximize tax credits, grow profitability and stay on track with other priorities, and a new industry-specific tax credit adds another consideration to the mix.

The Inflation Reduction Act extended Internal Revenue Code section 48C—the manufacturers’ tax credit—to provide an additional $10 billion in tax credits. That extension included the addition of section 45X, the advanced manufacturing production credit, which provides a tax credit for eligible renewable energy components produced in the United States. Under section 45X, eligible manufacturers can receive up to 10% of project cost reimbursements to produce certain renewable energy components—such as solar panels or electric vehicle batteries—including certain renewable energy minerals produced domestically.

The opportunity

The United States accounts for just over 2.5% of energy equipment production, according to data from Statista, ranking fifth globally compared to other countries. In 2021, the United States manufactured just under 5 gigawatts of solar panels domestically out of 200 gigawatts produced globally, according to the International Energy Agency. This indicates a huge opportunity, especially given the supply chain challenges of the last few years. Boosting domestic production of key renewable energy components is one long-term solution to those challenges.

But forming new relationships and shifting supply chain models takes significant time and financial resources that executives would rather not deploy now given the current economic outlook. Enter the section 45X advanced manufacturing production credit, which incentivizes domestic manufacturing by providing those financial resources. Onshoring these energy components will ultimately reduce lead/lag timelines and uncertainties, help alleviate supply chain pressures and lessen the production cycle exposure to external factors.

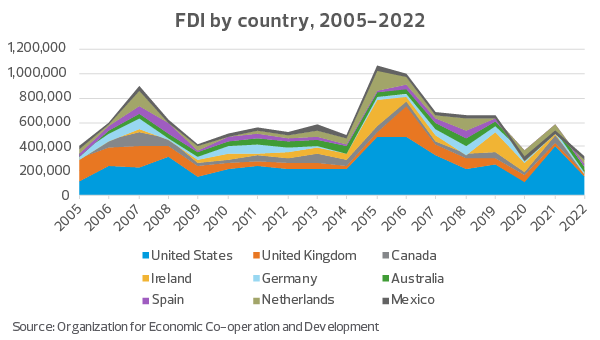

In addition to incentivizing domestic production, the extension of the tax credits makes U.S. production more appealing to foreign investors looking to expand their international presence, while also giving the United States access to broader customer networks. The United States is already the largest recipient of foreign direct investment, according to an International Monetary Fund survey from 2021, the most recent data available. FDI has many favorable outcomes for the U.S. economy, including new jobs, higher wages and increased U.S. exports. It also strengthens domestic manufacturing (approximately 40% of U.S. affiliates of foreign companies are in the manufacturing sector, according to the Global Business Alliance). FDI also provides for new research and technology and contributes to rising U.S. productivity through the availability of capital, which increases competition and helps to stabilize pricing.

Assessing resources and needs

To enhance its competitive advantage, a company must understand the criteria, implications and opportunities of the recent legislation. One area of significant opportunity is the electric vehicle market, given that many of the critical components/minerals outlined in the legislation are involved in battery manufacturing. Overall, we expect the section 45X credit—alongside other clean energy incentives—to boost the EV market’s progress toward its expansion goals.

While there is more opportunity than downside in using this credit, there may be some resistance given the upfront investments needed to take full advantage. Executives who are diligent in aligning their expansion and capital investment to take advantage of these credits will be best positioned in the long run. Companies will need to review their current capital capacity to understand the life span of their existing manufacturing plant capabilities. If capacity will be met within the next few years, investing sooner will best position companies for the financial and human capital resources needed for expansions and/or new facilities.

Data will also be central to supporting companies’ requests to receive the tax credits. This includes data about the company’s ability to monitor and reduce project lead times, as well as how the credits will boost job creation. Employing a third-party firm specializing in data analysis can help manufacturers obtain the most precise data in a timely manner, as manufacturers could start to receive tax credits immediately for sales of eligible products manufactured between Jan. 1, 2023, and Jan. 1, 2030.

For more information on tax credits under section 48C, refer to the RSM tax alert IRS releases Notice 2023-18 for credits under section 48C.

Let's Talk!

Call us or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Kendra Blacksher and originally appeared on 2023-04-28. Reprinted with permission from RSM US LLP.

© 2024 RSM US LLP. All rights reserved. https://rsmus.com/insights/industries/manufacturing/industry-impact-section-45x-advanced-manufacturing-credit.html

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

As CPAs, we know how to keep things balanced. At Schlenner Wenner & Co. we balance the resources of our professional staff with the individual needs of our clients. Our goal is to help clients keep their life in balance enabling both large and small businesses to become prosperous and reach their full potential.

Schlenner Wenner & Co. is proud of its record of maintained lasting relationships with both individuals and businesses. We are committed to providing you with quality work and innovative and timely solutions to your financial needs. Since our business started in 1964, we have learned a great deal, and we are ready to help your company grow and succeed. We are looking forward to working with you.

For more information on how Schlenner Wenner & Co. can assist you, please contact us.